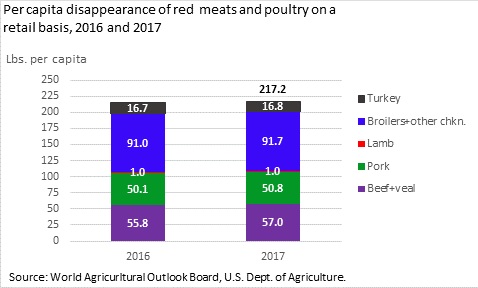

Red meat and poultry disappearance in 2017, as depicted in the figure below, is forecast to increase 2.6 pounds per person compared with last year, according to USDA’s March 15 Livestock, Dairy, Poultry and Outlook report available here.

Disappearance is the quantity of poultry and red meat that is used in domestic markets. Per capita disappearance is calculated by subtracting net exports and stocks changes from production and then dividing this result by the U.S. population.

In 2017, per capita disappearance of poultry and red meats on a retail basis is projected to be 217.2 pounds per person, 2.6 pounds more than the 214.6 pounds available per capita last year, according to the USDA report. This year, red meats (beef, pork, veal, and lamb) are expected to make up slightly more than half of disappearance (50.1 percent), while poultry will likely account for slightly less (49.9 percent).

In 2016, the breakdown between shares of poultry and red meats was the reverse: poultry comprised slightly more, 50.2 percent of total per capita disappearance, while red meats accounted for 49.8 percent. Although poultry production is expected to rise 2 percent this year, strong production increases of beef and pork, 4.1 percent and 4.7 percent, respectively, largely explain the share of red meat per capita availability in 2017.

Meanwhile, the USDA report said that broiler production and export trends have remained relatively stable, registering positive growth in January on a year-over-year basis. Egg production forecasts have been revised upward by a significant amount, largely due to revisions to historical data in February. Increased turkey poult placements in late 2016 and early 2017 indicate further production gains in the first half of 2017, but downward pressure on prices is expected to slow production growth in the second half of the year. The forecast for 2017 turkey production was reduced by 35 million pounds to 6.085 billion pounds.

USDA’s beef production forecast was adjusted higher for 2017 while, at the same time, beef and veal exports show strength. In the first 2 months of 2017, robust pork demand has supported hog and pork prices above year-ago levels despite year-over-year higher pork production. While first-quarter hog prices are expected to average more than 13 percent above year-ago levels, very large hog supplies are likely to pressure prices later in the year. However, on the flip side, larger pork supplies imply that continuing competitive pork prices are likely to draw interest from domestic and foreign pork buyers.