Broiler production expectations are increased for the rest of 2019 and 2020 based on gains in average bird weights, while the benchmark price is revised down. Broiler imports are revised down on the expectation for fewer shipments from key suppliers.

June broiler production is estimated at 3.5 million dozen, a 0.6-percent increase year-over-year or a 5.5-percent increase when adjusted for slaughter days. This increase was comprised of a 3.9-percent increase in birds slaughtered (adjusted for slaughter days) and a 1.6-percent increase in average aggregate bird weights. Preliminary weekly slaughter data from the Agricultural Marketing Service suggests that July slaughter and average weights will continue to be up year-over-year. USDA’s August Livestock, Dairy, and Poultry Outlook can be found here.

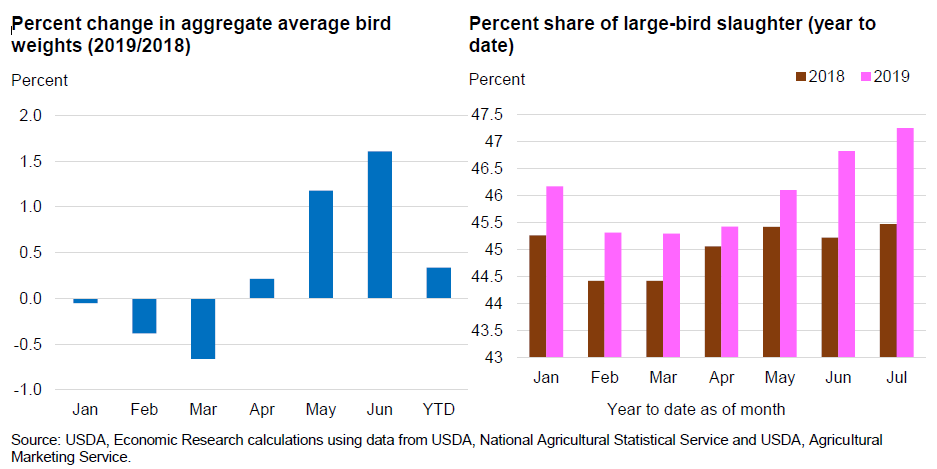

During the first 3 months of the year, aggregate bird weights were down year over year (see chart below), signaling what was thought to be a potentially negative outlook for gains in 2019 bird weights. However, in the second quarter, consistent year-over-year increases in average weights have pushed year-to-date average weights 0.3 percent higher than for the same period in 2018.

This increase can largely be attributed to the growing share of large-bird slaughter. On a year-to-date basis, the percent share of large-bird slaughter has consistently exceeded prior-year shares (see chart).

It is expected that large-bird slaughter will continue to increase for the remainder of 2019 and into 2020, supporting higher aggregate bird weights. Based on expectations that average bird weights will continue to gain, the third-quarter production forecast is revised up to 11.2 billion pounds and the fourth quarter is revised up to 10.8 billion pounds. Production for 2020 is revised up to 43.8 billion pounds, more than 1 percent higher than the 2019 production forecast.