In 2020, overall meat dollar sales increased 18.4% and volume sales grew 10.3% versus the same period last year, according to a recent report from 201 Analytics.

This translates into an additional $12.7 billion in meat department sales during the pandemic, which includes an additional $5.7 billion for beef, $1.6 billion for chicken and $1.1 billion for pork than during the same period in 2019.

| 2020 | Dollar sales | Dollar gains | Absolute dollar gains | Volume gains |

| Total meat (fresh + processed) | $82.0B | +18.4% | $12.7B | +10.3% |

| Total fresh meat | $55.0B | +19.8% | $9.1B | +10.3% |

| Total processed meat | $27.0B | +15.7% | $3.7B | +10.1% |

| Fresh beef | $30.2B | +23.1% | $5.7B | +12.0% |

| Fresh chicken | $13.4B | +13.9% | $1.6B | +9.1% |

| Fresh pork | $7.2B | +18.1% | $1.1B | +10.8% |

| Fresh turkey | $2.7B | +15.4% | $367M | +7.5% |

| Fresh lamb | $489M | +24.3% | $96M | +17.4% |

Meat Gains by Protein

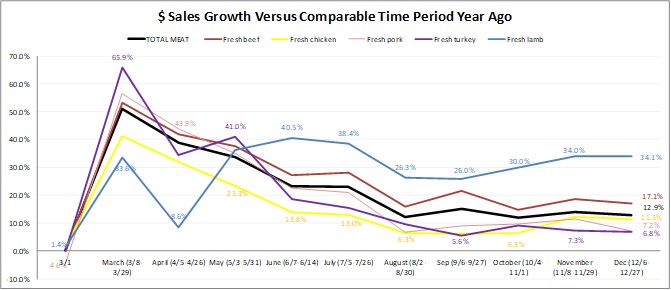

Gains by protein were very stable in the back half of the year. Lamb continued to have the highest percentage gains on its small base, at +34.1% versus the same month year ago. Lamb has kept their monthly gains very steady at 30-40% over year ago. With restaurants in many states closing back down in terms of on-premise dining, it is likely that more lamb sales will continue to flow through retail in the first part of 2021. Beef’s performance continued to be astounding, up 17.1% during December. Various high-end cuts had strong sales, perhaps a reflection of different holiday choices amid smaller gatherings. Chicken saw the smallest gains during the months of May through October, but had a strong December, at +11.5%.

Source: IRI, Integrated Fresh, Total US, MULO, 1 month % change vs. YA

Processed meats had a very strong month as well. Bacon and hot dogs led in percentage growth. This is quite an accomplishment for bacon as the largest of the processed meats at $509 million in December sales.

| 2020 $ sales gains versus comparable 2019 period | ||||||||||||

|

w.e. 3/1 |

Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| TOTAL meat | -0.4% | +52% | +35% | +30% | +20% | +20% | +11% | +15% | +12% | +14% | +12.9% | $6.4B |

| Processed meat | -1.8% | +55% | +29% | +23% | +14% | +14% | +9% | +14% | +12% | +13% | +10.6% | $2.2B |

| Bacon | -6.4% | +53% | +47% | +34% | +18% | +19% | +15% | +19% | +18% | +19% | +17.1% | $509M |

| Packaged lunchmeat | -4.3% | +48% | +20% | +9% | +6% | +5% | +3% | +6% | +7% | +9% | +9.7% | $391M |

| Dinner sausage | 2.7% | +67% | +41% | +34% | +20% | +16% | +11% | +18% | +12% | +14% | +10.2% | $329M |

| Smoked ham | -5.3% | +122% | +20% | +67% | +32% | +26% | +14% | +10% | +4% | +5% | +1.0% | $322M |

| Breakfast sausage | -4.4% | +56% | +43% | +40% | +23% | +20% | +18% | +23% | +15% | +12% | +11.7% | $192M |

| Frankfurters | -0.1% | +76% | +39% | +20% | +13% | +14% | +10% | +26% | +16% | +20% | +13.7% | $156M |

| Processed chicken | 5.1% | +40% | +13% | +14% | +12% | +7% | +4% | +7% | +7% | +17% | +19.0% | $41M |

Source: IRI, Integrated Fresh, Total US, MULO, % change vs. YA

Grinds

During December, the dominance of grinds in meat sales continued. Ground beef sales totaled $798 million or 202 million pounds. Ground beef alone added $68.9 million versus year ago levels in December. Altogether, the meat grinds listed below generated an additional $88 million during the December weeks versus $780 thousand for plant-based meat alternatives.

|

% sales change (December 12/6-12/27) versus year ago |

Dollar sales | Dollar gains |

| Ground beef | $798M | +9.5% |

| Ground chicken | $16M | +25.6% |

| Ground lamb | $3M | +30.3% |

| Ground plant-based meat alternatives | $4M | +21.2% |

| Ground pork | $15M | +10.1% |

| Ground turkey | $104M | +15.3% |

| Ground veal | $1M | -1.1% |

Source: IRI, Integrated Fresh, Total US, MULO, % change vs. YA

What’s Next?

In the latter half of the year, meat department gains have consistently been between 12-15% above year ago levels. The first quarter outlook for 2021 is likely going to continue to be dominated by news and concern over the virus and the vaccine and is likely going to generate similar sales results.

The mid-December shopper survey by IRI found that consumers’ expected length of the health crisis had shortened slightly this month since the vaccine distribution began, however the majority of Americans are braced for the health crisis to last through most of next year.

- 23% expect four to six more months

- 32% expect seven to 12 more months

- 35% expect the health crisis to last over 12 more months (down from 42% in November).

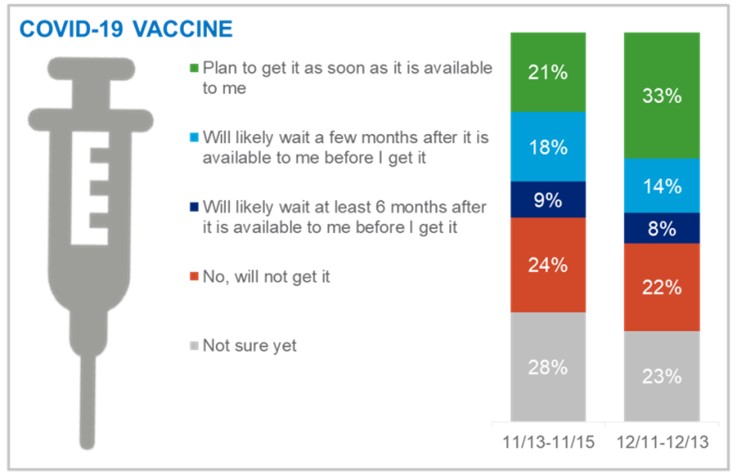

Interest in getting the COVID-19 vaccine grew over the past month, with over half now planning to get it, and more eager to get it as soon as possible. Still, 22% say they will not get it and 23% are not sure yet. Increased interest spanned demographics, with the strongest gains among age 55+ and Hispanics. Shoppers with lower incomes, those without college degrees, and younger Americans showed increases versus last month, but remain less interested than their counterparts.

The full 210 Analytics report can be viewed here.