The first-half broiler production forecast was lowered, in part on production disruptions caused by a winter storm in Southern States. The broiler export forecast was decreased on expectations for lower demand from China and uncertainty in other key markets. The second-quarter broiler price forecast was increased on recent price movements and expectations for improving demand, according to USDA’s March 2021 Livestock, Dairy, and Poultry Outlook report.

Mid-February’s ice storm caused disruption to broiler production at various stages of the supply chain in Texas, Mississippi, Louisiana, and Oklahoma. A number of broiler houses, processing plants, and hatching operations were all affected. The impact of the storm has surfaced in both broiler slaughter data as well as hatchery data.

For the week ending February 20, 2021, preliminary broiler slaughter data indicates a 43.9 percent year-over-year decrease in broiler processing volumes. There have been reports that the industry attempted to make up for the reduced slaughter that week through increased shifts and weekend slaughter in the following week, which subsequent-week data affirms by a 4.4 percent year-over-year increase in slaughter. The preliminary slaughter data points to notably lower slaughter volumes in February year-over-year. Further, eggs set and chick placement data indicate fewer birds available for slaughter, likely into April. As a result, the first-half production forecast was lowered to 22.080 billion pounds. Production for 2021 is forecast to total 44.780 billion pounds, less than a half-percent higher than 2020 production.

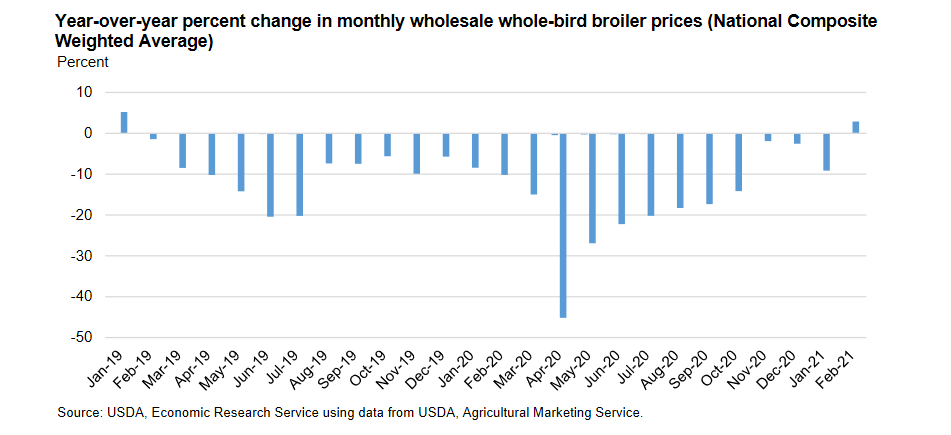

Wholesale whole-bird broiler prices (National Composite Weighted Average) averaged 83.0 cents per pound in February, 2.9 percent higher year-over-year, according to USDA. February marks the first month since January 2019 in which the monthly broiler benchmark price was higher year over year. For the last two years wholesale prices have been weighed down by abundant supplies that outmatched demand, as well as market disruptions stemming from the COVID-19 pandemic.

For the rest of the year, wholesale prices are expected to remain above year-earlier levels, in large part because 2020 prices were severely depressed due to COVID-19 but also due to improving demand tied to the recovery of the hotel, restaurant, and institution sector. The second-quarter price forecast was increased to 92 cents per pound. For 2021, prices are forecast to average 85 cents per pound, an increase of 16 percent over 2020.