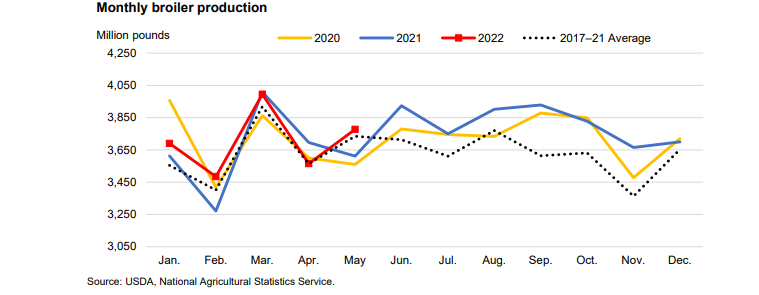

May broiler production totaled 3.778 billion pounds, 4.6 percent more than the same month last year. This increase was partially a result of an additional slaughter day compared with last May, according to USDA’s latest Livestock, Dairy, and Poultry Outlook. On a similar per day basis, slaughter was 5.6 percent higher. However, this was partly offset by lower bird weights. Average weights in May were 0.6 percent below a year ago but were slightly higher than April. Preliminary data does not indicate that June production was much stronger than last year. Consequently, the second-quarter production estimate was revised down to 11.250 billion pounds.

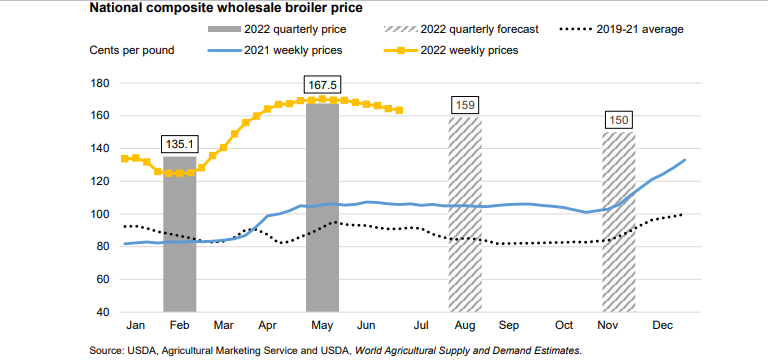

The June average wholesale composite whole-broiler price was 165.83 cents per pound, making the second-quarter average 167.5 cents per pound. Weekly prices have continued the decline that began in mid-May, averaging 162.48 cents per pound in the first week of July. The third-quarter forecast price was decreased by 6 cents to 159 cents per pound on this price softening. Forecasts for the fourth-quarter of 2022 and all of 2023 remain unchanged.

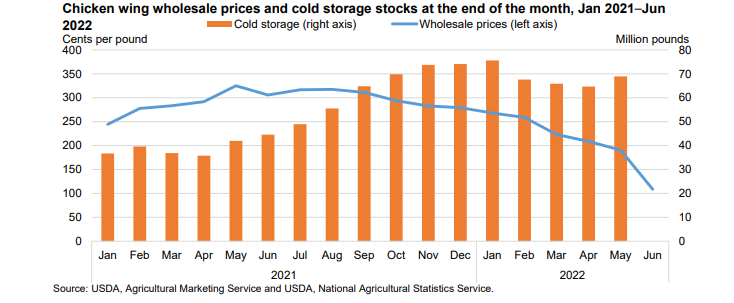

While wholesale prices for most chicken parts, including legs, tenders, and thighs, increased month over month, prices for both boneless skinless breasts and wings have decreased. Wing prices have been declining since late summer 2021, but the June average fell to 108.59 cents per pound, the lowest since April of 2020. While wings in cold storage are down from the peak at the end of January, they increased 6.5 percent from the end of April to the end of May. Greater availability of wings in a season without a major sporting event to drive demand likely helped pull prices down.

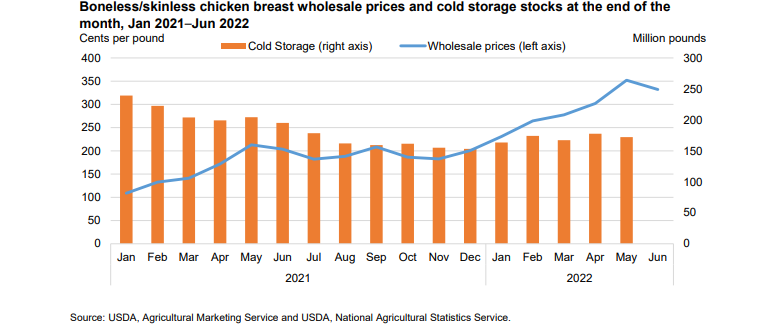

Wholesale prices for boneless/skinless chicken breasts finally fell from record highs to 332.13 cents per pound on average in June. This is 129 cents above the previous June but a decrease of 20 cents from the May average. While breast meat in cold storage is still below average, it has leveled off in recent months, ending May 2022 at 172 million pounds. Relatively small changes in stocks from one month to the next indicate that demand is likely not outpacing the month’s production, nor is monthly production outpacing the month’s demand. This likely lessened the upward pressure on prices.

USDA’s full report can be viewed here.