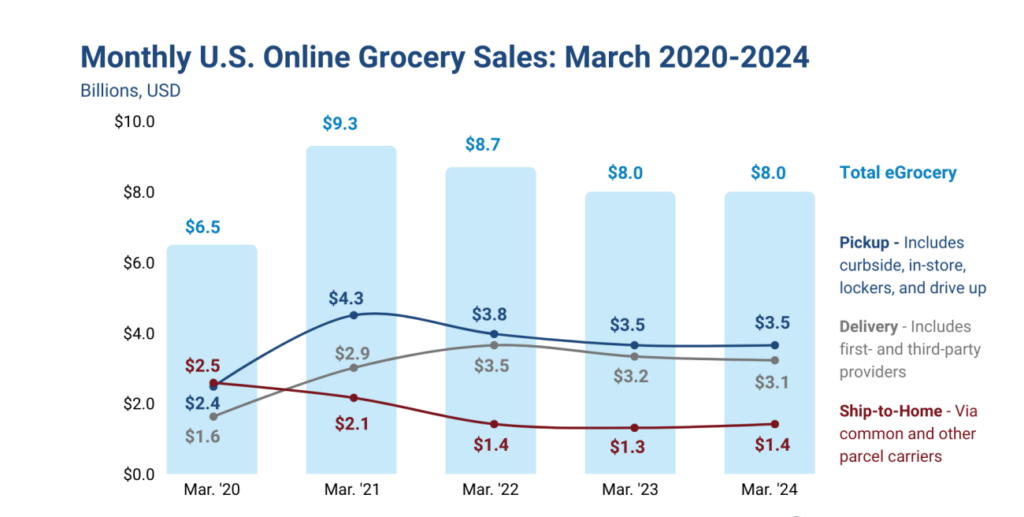

Online grocery sales in March remained flat compared to last year, with total sales reaching $8 billion. According to the most recent Brick Meets Click/Mercatus Grocery Shopper Survey, fielded March 29-30, the results are an improvement over March 2023, when total monthly online grocery sales had fallen 8% on a year-over-year basis.

March sales were 23% above the levels posted in March 2020, the initial month of the pandemic in the U.S. Sales remained mostly flat compared to February as well, when online grocery sales totaled $7.9 billion.

Pickup and delivery share grew in March at the expense of ship-to-home. Pickup, which accounted for less than one-third of eGrocery sales in 2019, quickly moved to the top spot when the pandemic started and it has stayed there ever since, expanding 586 basis point (bps) from March 2020 to 43.2% this year. Delivery, which represented one-quarter of all online sales in 2019, experienced an even larger jump in market share, expanding by 1,488 bps during the same period to end March 2024 with 39.1%.

“While most people recognized that the pandemic was a catalyst for buying groceries online, few could fully anticipate the implications of that surge,” said David Bishop, partner at Brick Meets Click. “Now, four years after COVID-19 first impacted our everyday lives, eGrocery in the U.S. looks very different from both a contribution and growth perspective, and this will impact how grocers and others expand and drive profitability in their respective businesses moving forward.”

Online grocery sales for March peaked in 2021 and have declined or been flat on a year-over-year basis since then. Ship-to-home peaked in March 2020, while pickup hit its highest level in 2021, and delivery did so in 2022. Ship-to-home posted a gain of 5.9% in sales in March 2024 versus last year, while pickup’s sales were unchanged, and delivery’s monthly sales decreased 2.6%.

Brick Meets Click found that most U.S. households continue to have strong preferences for how they receive their online grocery orders. The share of monthly active users (MAUs) that used only one method during the past 30 days has climbed 340 bps to 71.7% from March 2020 to 2024. However, the method(s) that households use has shifted. Since March 2020, the share of MAUs that used pickup has increased more than 10 percentage points, finishing March 2024 at 54.8%. The share of MAUs that used delivery rose over 12 points to 38.4%, and ship-to-home’s share of MAUs dropped almost 20 points.

Competition online for the active customer has also gotten more intense for Supermarkets – especially from Walmart. Before COVID, only 15% of the customers who bought online from grocery stores (which includes supermarkets and hard discount retailers) also completed an online grocery order from a mass retailer during the same month. For March 2024, that cross-shopping rate stands at nearly 27% as high prices continue to motivate some households to change where they buy groceries.

“Helping customers build their basket of goods by using tactics like personalized offers or targeted deals is not just key to growing sales but also to improving the chances that they’ll come back again,” said Mark Fairhurst, Global Chief Growth Officer at Mercatus. “For today’s grocers, keeping your online customers engaged is more important than ever as growth is now more likely derived from increased order frequency and/or spend per order.”

Source: Brick Meets Click