Fresh meat increased dollar sales by 5.3 percent in December, easily offsetting the slight 0.6 percent decrease in processed meat, leading to an overall 3.4 percent increase over December 2023, according to the latest Performance Report from Circana, 210 Analytics, and Hillphoenix. The four December weeks generated $8.9 billion, with $6.2 billion for fresh meat. While inflation played a role, pound sales increased by 0.3 percent in fresh, but this result was pulled down by the 2.9 percent decrease in processed for an overall loss of about one percent year-on-year.

The report notes that it is important to keep in mind that the date cut-off in both years is likely to have impacted the December results. The months always run through a Sunday, which meant December 29 in 2024 and December 31 in 2023. The difference lies in the New Year’s celebration dollars that will likely shift to the January 2025 report, at least in part.

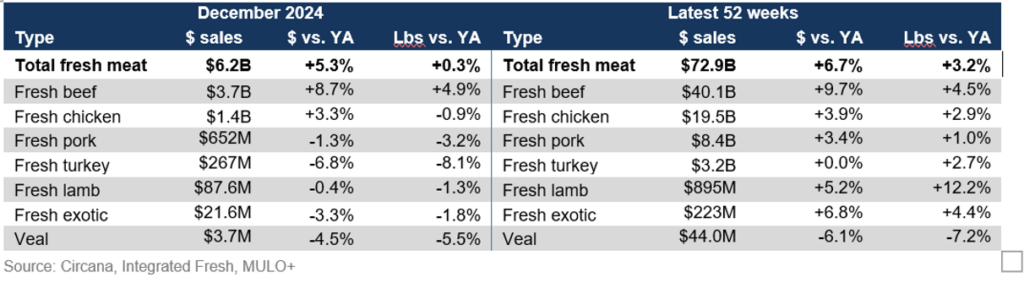

Fresh Meat Sales by Protein

While beef prices are 3.7 percent higher than last year, pound sales increased 4.9 percent in December, which was far better than the results seen in chicken and beef. Much of the growth is driven by ground beef, as seen later in this report.

The entire fresh meat aisle had a strong 2024 performance with gains for all but veal. In the full-year view, lamb had the highest year-on-year pound increases, at +12.2 percent, followed by beef and exotic (mostly bison).

Processed Meat

Processed meat reflects a range of performances in December. While packaged lunchmeat and smoked ham decreased year-over-year in pound sales, processed chicken had a big month. The full-year performance was far better for processed meat. Both dollar and pound sales were stable, reflecting pound gains for dinner and breakfast sausage, bacon, and processed chicken.

| December 2024 | Latest 52 weeks | ||||||||

| Type | $ sales | $ vs. YA | Lbs vs. YA | Type | $ sales | $ vs. YA | Lbs vs. YA | ||

| Processed meat | $2.7B | -0.6% | -2.9% | Processed meat | $31.6B | +0.4% | +0.0% | ||

| Bacon | $618M | +3.8% | -0.4% | Packaged lunchmeat | $7.1B | -1.9% | -0.8% | ||

| Packaged lunchmeat | $507M | -1.4% | -4.7% | Bacon | $6.9B | +4.4% | +1.6% | ||

| Dinner sausage | $433M | +0.2% | -0.1% | Dinner sausage | $5.6B | +3.0% | +3.5% | ||

| Smoked ham | $396M | -1.5% | -3.9% | Frankfurters | $3.2B | +1.9% | -0.8% | ||

| Breakfast sausage | $241M | +4.8% | +0.8% | Breakfast sausage | $2.4B | +3.8% | +2.1% | ||

| Frankfurters | $184M | -0.3% | -1.7% | Smoked ham | $1.9B | -1.2% | -1.5% | ||

| Processed chicken | $54.3M | +9.4% | +9.4% | Processed chicken | $752M | +1.0% | +3.5% | ||

Source: Circana, Integrated Fresh, Total US, MULO+