Life remained home-centric in late summer, with an estimated 78% of all meal occasions being prepared at home, according to the September IRI primary shopper survey. While this is down 10 points from the very start of the pandemic, the high inflationary levels are keeping the food dollar largely at retail.

Consumers are still ordering restaurant meals, but not as often as before plus they are making changes to what they order with an eye on the check total.

- 82% of American households bought at least one restaurant meal in September, with the highest restaurant penetration among higher-income households, at 91%. Only 69% of households who are earning less than $25,000 annually ate at restaurants at least once in September. Restaurant engagement is also lower in the Midwest and among older shoppers.

- Takeout continues to be big, with 54% having ordered meals to go in September. Half of American households have eaten restaurant food on premise. Additionally, 18% have ordered from a restaurant for home delivery (down two points from August). Home delivery is much more popular among high-income households as well as the youngest shoppers. For October, 54% of consumers expect they will eat out as often, while 24% believe they will cut back on restaurant spending further.

- When purchasing groceries, 83% of consumers shopped in person, down from 85% in August. Online shopping was near equally divided between click-and-collect (10%) and home delivery (8%). Shoppers are not expecting a major change in their in-person versus online shopping: 4% expect they will buy all groceries online in the next few weeks and months, while 68% believe they will buy all groceries in person. The estimates among the remaining 28% range from expecting to buy most groceries (8%) to only some (7%) online.

- Spending continues to be affected by out-of-stocks, with 38% of shoppers mentioning examples of items they meant to buy but were unavailable, ranging from carbonated drinks to milk, canned goods, eggs and chicken. This leads to shoppers substituting, switching stores or abandoning the intended purchases altogether — all affecting sales. At the same time, when items are available for purchase, 40% of shoppers stock up on staples out of concern for rising prices or the item being unavailable next time they shop.

- In line with reality, price perceptions remain high with 94% believing grocery prices are somewhat or a lot more than before. Equally as many are concerned about food inflation. Eight in 10 shoppers (78%) are making changes to their shopping choices due to increased prices. The most popular money-saving measures are looking for sales/deals more often (49%), cutting back on non-essentials (43%), looking for coupons (30%) and buying store-brand items more often (28%). Despite the high gasoline prices, 15% switched some of their shopping to a lower-cost retailer and/or visit multiple stores to get the best deals. This cherry-picking behavior may be driven by 55% of consumers reporting that fewer of the items they are looking for are on sale and 44% feel that items are not discounted as much as they used to be.

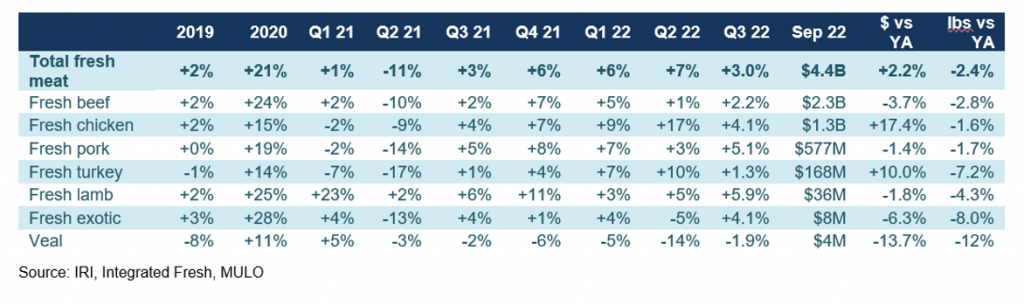

Fresh Meat by Protein

Total fresh meat sales were up 2.2% in September. Poultry delivered big, but this was inflation driven. Beef and pork, that had much milder inflation, experienced slight year-on-year declines in both dollar and pound sales.

The full report can be found by clicking here.